Cristiano Ronaldo committed tax evasion, Spanish Tax Agency finds

Inspectors believe Real Madrid star avoided paying more than €8m on income from his image rights

The Spanish Tax Agency believes that between 2011 and 2014, Real Madrid’s soccer star Cristiano Ronaldo evaded paying a lot more than the €8 million sum that has already been in the headlines. That is despite the fact that the Portuguese player regularized his situation with the authorities and paid a large sum of money in back taxes after it emerged that he had offshore funds deposited in the Virgin Islands, legal sources have confirmed.

The Cadena SER radio network revealed this week that the Tax Agency has sent the investigation into Ronaldo to the Madrid financial crimes prosecutor. The report it sent concludes that the player committed tax offenses, and has supplied its investigations so that the prosecutor can begin a legal probe.

According to news agency Europa Press, the amount evaded is closer to €15 million

The news comes a day after the Spanish Supreme Court confirmed a 21-month jail sentence and fine for Barça star Lionel Messi for three tax offenses.

The Tax Agency refuses to comment on Ronaldo’s situation, stating that the law prevents it from supplying any information about a taxpayer. Other legal sources explain that tax inspectors have concluded that the Real Madrid player evaded paying an amount that is “much higher” than the €8 million figure that had already been leaked until now.

According to news agency Europa Press, the amount evaded is closer to €15 million.

Ronaldo had transferred income from his image rights into a number of companies in the Virgin Islands from 2009 onward, four months before arriving at Real Madrid. The forward decided to regularize his situation after the Spanish Tax Agency began a campaign to inspect the money being made by the country’s soccer stars. Ronaldo has been subject to an inspection for the years 2011, 2012, 2013 and 2014.

In the Virgin Islands alone he is thought to have deposited €150 million of income from his image rights

The athlete brought to light the money he held offshore in his 2014 tax return. The Tax Agency believes that despite this, he has committed an offense, one that is aggravated by the attempt to hide his taxable income.

The more than €8 million supposedly evaded by the Portuguese player amount to the difference between what he paid in tax after declaring the funds he held in tax havens, and the calculations made by tax inspectors as to how much he really should have paid to legalize the fortune he had stashed abroad. In the Virgin Islands alone he is thought to have deposited €150 million of income from his image rights.

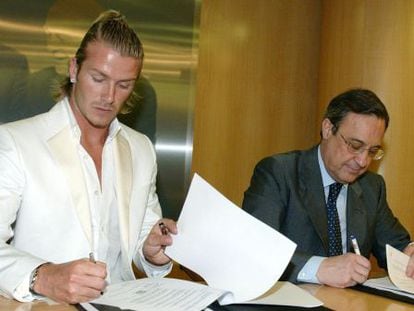

When Ronaldo arrived at Real Madrid he took advantage of the tax breaks that he was eligible for under the so-called “Beckham law,” named after the English player David Beckham who also played for the club in the capital. The legislation gave Spanish clubs an enormous advantage when it came to signing players, given that it’s “galácticos,” as these star players were known, had to pay a tax rate similar to workers on a minimum wage: just 24%. But that law was changed in 2010.

Since then that rate has only been applied to those earning less than €600,000 a year, a figure that is well below the income of any of Spain’s major soccer stars.

The sources cited by Cadena SER explain that the player legalized his fortune before being investigated, and that since then there has been no attempt to hide any income and that the Tax Agency has received all of the relevant contracts that justify his earnings.

English version by Simon Hunter.